Texas No Tax Due Report 2024

Texas No Tax Due Report 2024. Texas franchise taxpayers will see changes to no tax due reporting for 2024. For reports originally due on or after jan.

Effective for reports originally due on or after january 1, 2024, l. No tax due threshold increases to $2,470,000 for report year 2024.

The Texas Comptroller Of Public Accounts Sept.

But as dehaan points out, what makes this “essentially.

7, 2022, 5:00 Am Utc.

Changes to texas franchise no tax due reports for 2024.

1) Whether A Passive Entity Is The Same For Franchise Tax As It Is For Federal Tax;

Images References :

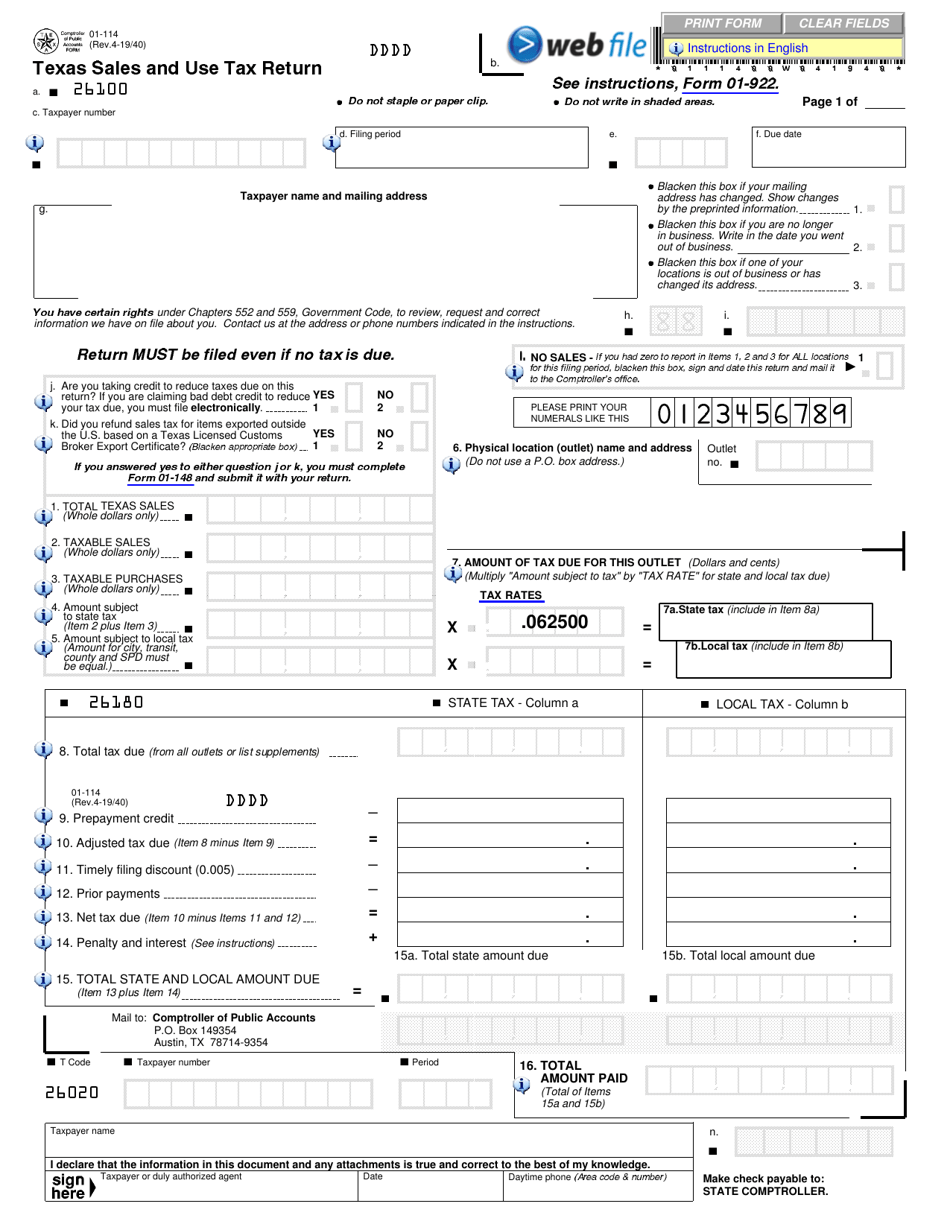

Source: www.dochub.com

Source: www.dochub.com

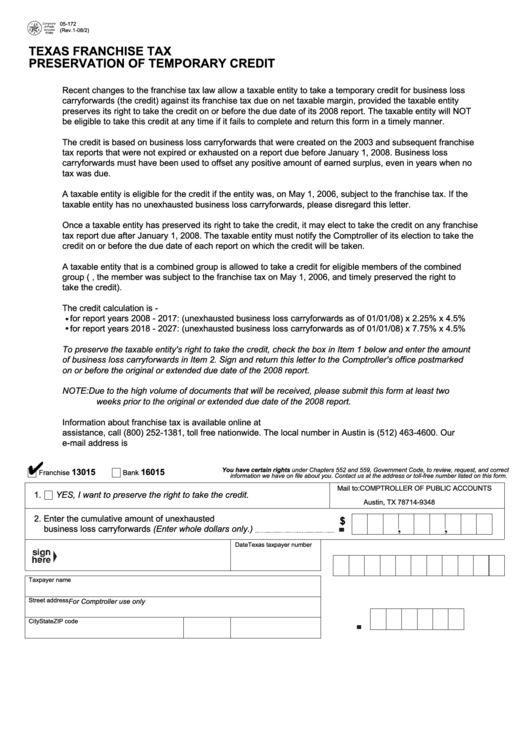

Zero texas gross receipts Fill out & sign online DocHub, A recent tax policy newsletter as issued by the texas comptroller of public accounts (comptroller) addresses that effective for texas franchise tax reports originally due on. In its november 2023 policy news alert, the texas comptroller of public accounts (the comptroller) discussed senate bill 3 (sb3) and the bill’s impact on texas.

Source: franchise-faq.com

Source: franchise-faq.com

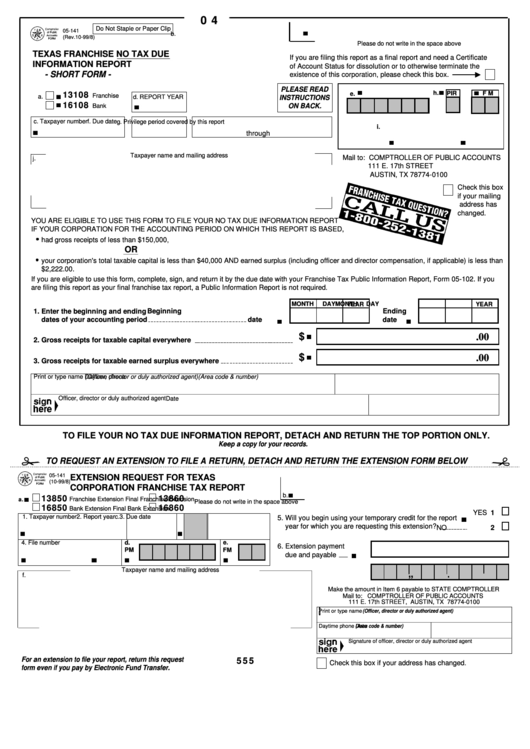

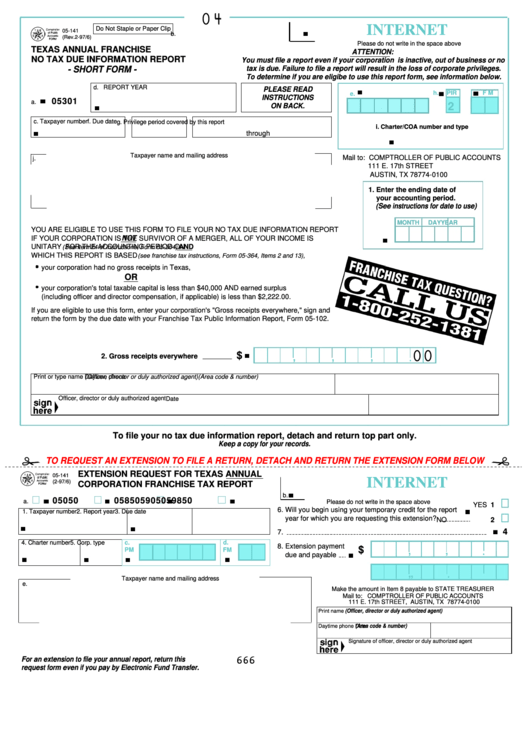

How To File Texas Franchise Tax No Tax Due Report, How to file a no tax due report & public information report. In 2024, the texas sales tax holidays will be held on the following dates:

Source: franchise-faq.com

Source: franchise-faq.com

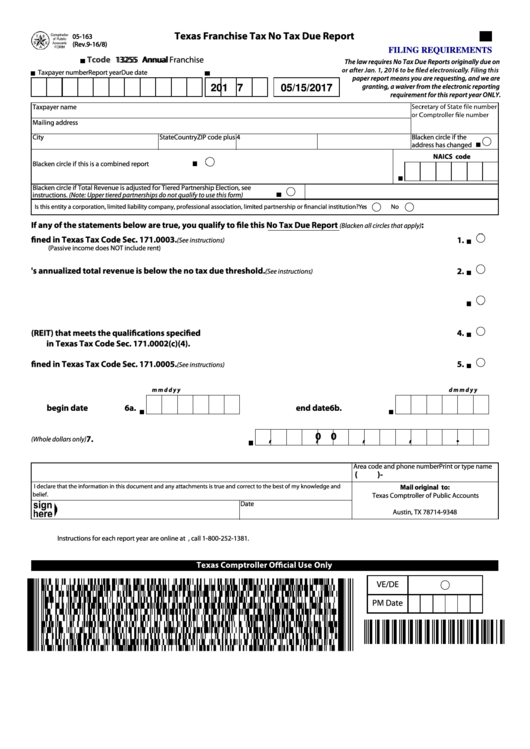

How To File Texas Franchise Tax No Tax Due Report, 1, 2024, the no tax due threshold is increased to $2.47 million doubling the amount of a taxable entity's total revenue that is exempted. Texas franchise taxpayers will see changes to no tax due reporting for 2024.

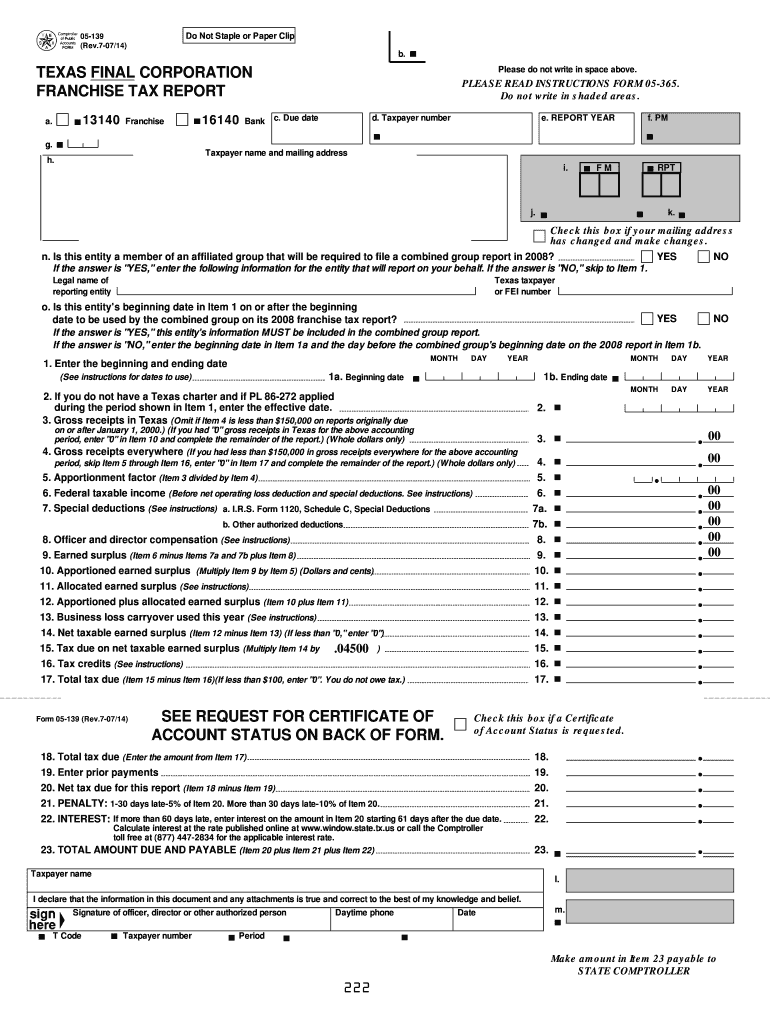

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Texas Franchise Tax Annual No Tax Due Report printable pdf, 1, 2024, senate bill (sb) 3, 88th legislature, second called session, increases the no tax due threshold to $2.47 million. Those costs are passed on to the buyer,.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 05141 Texas Franchise No Tax Due Information Report, Texas franchise taxpayers will see changes to no tax due reporting for 2024. No tax due threshold has increased to 2.47 million for reports due on or after january 1, 2024.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 05141 Texas Annual Franchise No Tax Due Information, Businesses under $2.47m in receipts must file a public/ownership report instead. In july 2023, the texas legislature passed senate bill 3, which increased the no tax due threshold and.

Source: www.templateroller.com

Source: www.templateroller.com

Form 01114 Download Fillable PDF or Fill Online Texas Sales and Use, Taxpayers can file their 2023 federal and state tax returns using irs free file through early november. 2023, s3 (2nd s.s.) increases the no tax due revenue threshold to $2.47 million.

Source: mungfali.com

Source: mungfali.com

Texas Tax Chart Printable, Changes to texas franchise no tax due reports for 2024. Free file helps millions of taxpayers each year to file tax returns for free and.

Source: www.dochub.com

Source: www.dochub.com

Texas franchise tax instructions 2023 Fill out & sign online DocHub, How to file a no tax due report & public information report. 1) whether a passive entity is the same for franchise tax as it is for federal tax;

Source: www.youtube.com

Source: www.youtube.com

How to File a No Tax Information Report YouTube, Effective january 1, 2024, the no tax due reporting threshold for business entities formed or qualified to do business in the state of texas will increase from $1.23. Saturday, april 27, through monday, april 29, 2024.

The Texas Franchise Margin Tax.

Texas comptroller issues faqs on franchise tax payment, reporting requirements.

No Tax Due Threshold Has Increased To 2.47 Million For Reports Due On Or After January 1, 2024.

The texas comptroller of public accounts sept.